The Thorough Method to Smart Financial Debt Administration and Long-Term Financial Freedom

The trip to financial freedom frequently begins with a clear understanding of one's financial obligation landscape and the effect it has on general monetary health and wellness. By diving right into approaches that incorporate wise financial debt management techniques and prudent monetary planning, individuals can lead a course in the direction of not simply debt liberty yet likewise sustainable monetary well-being.

Understanding Debt and Financial Health

To comprehend the detailed connection in between financial obligation and financial wellness, one should initially delve right into the fundamental concepts of borrowing and its influence on overall financial stability. Financial obligation, in its essence, is a monetary device that enables people and entities to take advantage of sources beyond their present means.

Monetary wellness, on the other hand, incorporates the ability to handle financial debt properly while keeping a balanced budget plan and financial savings plan. Recognizing the types of financial debt, such as revolving credit rating, installation lendings, or home loans, is crucial in making educated loaning decisions. Checking debt-to-income ratios, credit rating, and rate of interest additional adds to a person's overall financial wellness.

Setting Clear Financial Goals

Developing clear monetary objectives is an essential step towards accomplishing long-lasting monetary stability and success. Establishing certain, quantifiable, possible, pertinent, and time-bound (CLEVER) objectives gives a roadmap for your economic trip. Begin by reviewing your existing economic scenario, consisting of earnings, expenses, financial obligations, and cost savings. Determine areas for enhancement and identify what you desire to achieve economically in the short, medium, and lengthy term. Whether your objectives entail conserving for retirement, purchasing a home, starting a business, or paying off financial debt, plainly specifying them will certainly assist you stay focused and encouraged.

Frequently review and change your monetary objectives as required to mirror changes in your conditions or priorities. By establishing clear economic objectives and constantly working towards them, you can pave the means for an extra protected and prosperous financial future.

Structure and Applying a Budget

When embarking on the course to financial security, one vital step is developing and carrying out an extensive budget strategy. Designate a portion of your revenue to cost savings and prioritize financial debt repayments. By faithfully complying with a budget plan, you can take control of your financial resources, decrease financial debt, and work in the direction of accomplishing long-term monetary liberty.

Prioritizing Financial Debt Repayment Strategies

Having developed a solid spending plan foundation, the following crucial step in accomplishing financial security is purposefully prioritizing financial debt payment strategies. Focusing on debt payment entails identifying and concentrating on high-interest financial debts first, such as bank card balances or payday advance, to reduce the general passion paid over time. By dealing with high-interest financial debts early on, individuals can minimize the economic worry and totally free up a lot more funds for various other economic objectives.

Another effective technique is the financial obligation snowball approach, where financial look here debts are paid off in order from smallest to largest balance. This method can offer a mental increase as smaller sized financial obligations are removed initially, encouraging people to proceed the check this financial debt settlement trip. On the various other hand, the financial debt avalanche approach entails focusing on financial debts with the highest rates of interest despite the balance size. While this method may save more on interest payments in the lengthy run, it might take longer to see specific financial debts completely settled.

Investing in Long-Term Financial Security

To secure lasting economic stability, prudent investment methods customized to private financial objectives are essential. Investing in lasting monetary stability involves a calculated strategy that takes into consideration elements such as threat tolerance, time perspective, and financial goals. Diversity, the method of spreading out investments throughout various asset courses, can aid alleviate threats and enhance returns with time. It is essential to perform comprehensive study or look for assistance from economic experts to make informed financial investment choices aligned with one's long-lasting monetary strategies.

Regularly examining and adjusting financial investment portfolios as economic objectives evolve is additionally essential to keeping a durable economic technique. By focusing on long-lasting economic stability with thoughtful investments, people can function towards attaining lasting monetary security and self-reliance.

Conclusion

Kel Mitchell Then & Now!

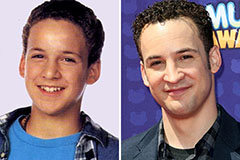

Kel Mitchell Then & Now! Ben Savage Then & Now!

Ben Savage Then & Now! Hallie Eisenberg Then & Now!

Hallie Eisenberg Then & Now! Elin Nordegren Then & Now!

Elin Nordegren Then & Now! Erika Eleniak Then & Now!

Erika Eleniak Then & Now!